Investment types are often broken down into the categories of Value and Growth. While these strategies focus on whether the company is cheap or has exponential expansion potential, the Windrose Ventures investment thesis is focused on something else – impact.

Impact Archetype

An impact startup does not simply add incremental improvements to an existing market offering. They challenge an industry’s weak points and exploit its fault lines to disrupt the linear progression. These startups are hyper-focused on the potential of outputs rather than inputs, and envision the new way the world will look once the company has achieved scale.

A company that is creating a new sub-industry must first deliver products/services at a premium price in order to generate awareness. This enables the firm to bring down costs and reach democratization. At this stage the TAM is narrow but deep and the customer base is sticky in nature. Their customers have an emotional attachment to the company’s purpose and intuitively recognize the influence it can have in shaping the world.

The impact-driven startup will produce diversified returns – financial and societal – and the societal impacts will far outlast the company’s financial value. Investing in purpose does not permit neglecting fundamentals. A company that has the potential to improve communities must possess strong strategic direction, proven leadership, and a viable profit playbook.

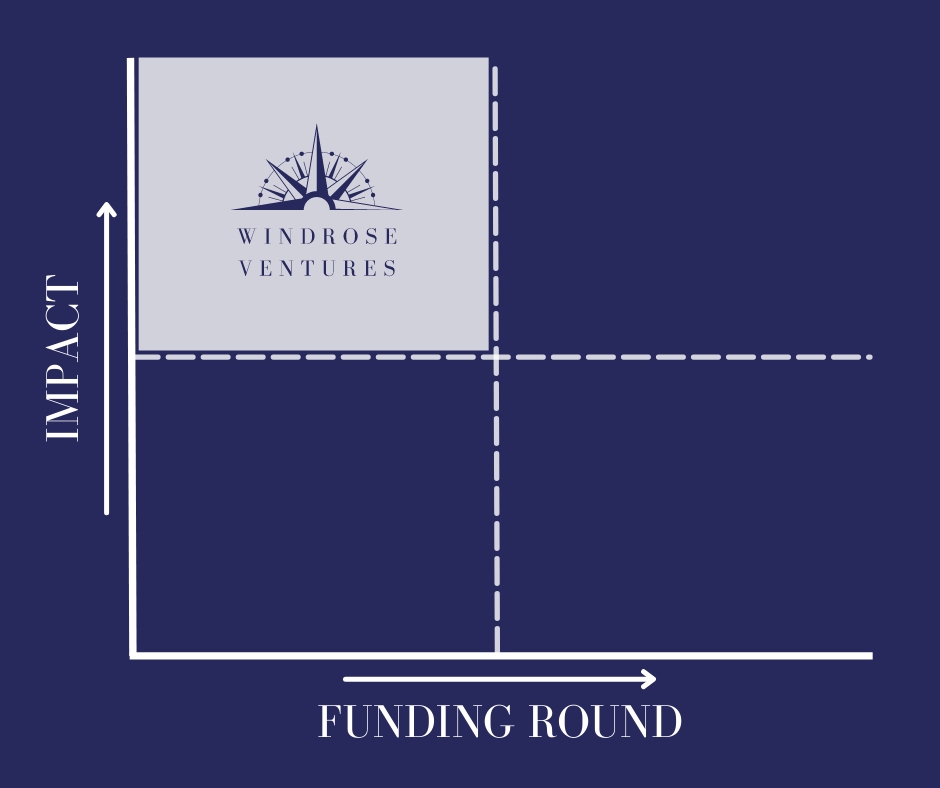

Timing it Right

Working with nascent companies that have a proven concept allows us to work side-by-side with our founders to rapidly iterate and implement strategies for product development, distribution selection, and marketing. Early partnership aids in avoiding costly mistakes and setting a scaleable trajectory, achieving comprehensive stakeholder returns.